How Thomas Insurance Advisors can Save You Time, Stress, and Money.

Wiki Article

Excitement About Thomas Insurance Advisors

Table of ContentsThings about Thomas Insurance AdvisorsThomas Insurance Advisors Things To Know Before You Get ThisThe Ultimate Guide To Thomas Insurance AdvisorsA Biased View of Thomas Insurance Advisors

We can't prevent the unexpected from happening, but often we can secure ourselves as well as our families from the worst of the financial after effects. Selecting the best kind as well as amount of insurance is based upon your specific scenario, such as kids, age, way of living, and work benefits - https://www.evernote.com/shard/s433/sh/c5220b62-487a-b5fd-abe5-fefa2986dbb9/vDJYCHMj12nCCt4e-MUq6Npdi8bH6n4TXj2bMwDlWQMQnx3TRgrowH-FVw. 4 sorts of insurance that many monetary specialists advise consist of life, health and wellness, vehicle, and long-lasting disability.Health and wellness insurance protects you from devastating expenses in case of a major accident or ailment. Vehicle insurance policy avoids you from bearing the economic worry of a pricey accident.

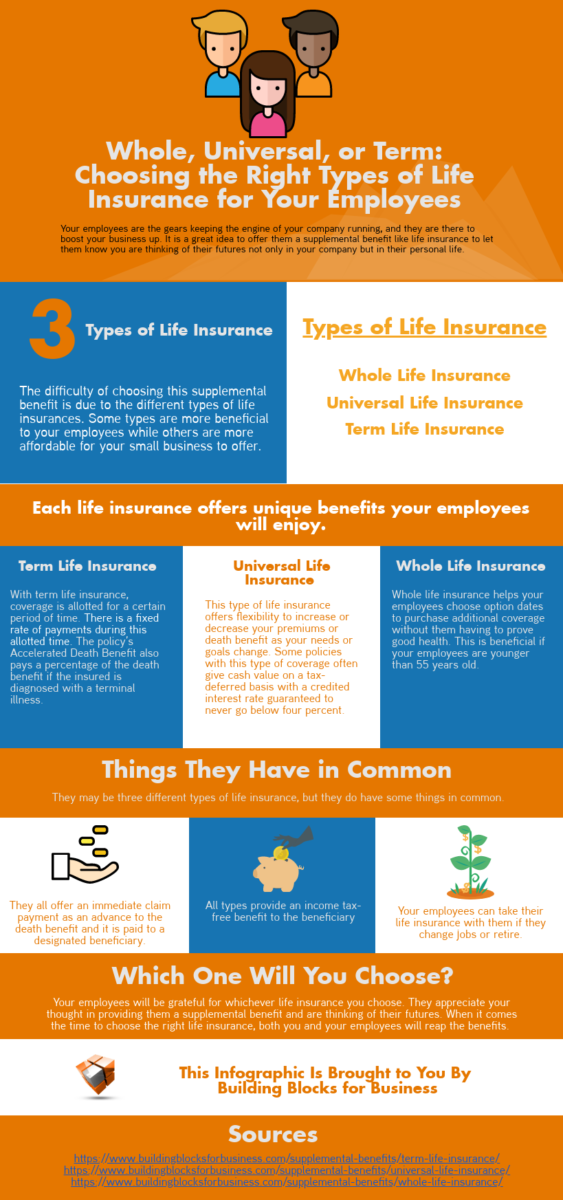

It includes a survivor benefit as well as also a cash value part - https://jstinsurance1.godaddysites.com/f/thomas-insurance-advisors. As the worth grows, you can access the cash by taking a loan or taking out funds and you can end the policy by taking the cash money value of the plan. Term life covers you for a set amount of time like 10, 20, or thirty years as well as your costs remain secure.

Some Known Questions About Thomas Insurance Advisors.

9% of married-couple households in 2022. They would be likely to experience monetary difficulty as an outcome of one of their wage earners' deaths., or private insurance you purchase for yourself and also your household by contacting health insurance coverage business directly or going through a health insurance representative.

If your earnings is low, you might be among the 80 million Americans that are eligible for Medicaid. If your income is moderate yet does not extend to insurance coverage, you might be qualified for subsidized insurance coverage under the federal Affordable Care Act. The best and least pricey choice for employed staff members is normally taking part in your employer's insurance program if your company has one.

According to the Social Safety Administration, one in 4 employees getting in the workforce will become disabled before they reach the age of retirement. Insurance in Toccoa, GA. While wellness insurance pays for a hospital stay and also clinical bills, you are commonly burdened with all of the costs that your paycheck had actually covered.

The Facts About Thomas Insurance Advisors Revealed

This would certainly be the most effective choice for securing cost effective handicap coverage. If your employer does not offer long-lasting protection, below are some points to take into consideration before purchasing insurance on your very own: A policy that ensures earnings replacement is ideal. Numerous plans pay 40% to 70% of your revenue. The expense of disability insurance policy is based upon many variables, including age, way of living, as well as wellness.Numerous strategies call for a three-month waiting period prior to the protection kicks in, provide a maximum of three years' worth of protection, as well as have significant plan exclusions. Here are your choices when acquiring car insurance policy: Obligation coverage: Pays for property damages as well as injuries you cause to others if you're at mistake for an accident and likewise covers lawsuits prices and also judgments or settlements if you're filed a claim against since of an auto accident.

Comprehensive insurance policy covers theft as well as damage look these up to your cars and truck because of floods, hail storm, fire, vandalism, dropping things, and animal strikes. When you fund your cars and truck or lease an automobile, this kind of insurance policy is necessary. Uninsured/underinsured motorist (UM) protection: If a without insurance or underinsured vehicle driver strikes your lorry, this insurance coverage spends for you as well as your traveler's clinical expenditures and may also make up lost earnings or make up for pain and suffering.

5 Simple Techniques For Thomas Insurance Advisors

Medical repayment insurance coverage: Med, Pay protection assists pay for medical expenditures, usually between $1,000 and $5,000 for you and also your passengers if you're injured in a crash. Similar to all insurance policy, your conditions will certainly establish the expense. Contrast numerous price quotes and also the coverage supplied, and inspect occasionally to see if you get approved for a reduced rate based on your age, driving document, or the area where you live.Employer protection is frequently the very best option, however if that is unavailable, acquire quotes from several suppliers as numerous offer discount rates if you buy even more than one kind of insurance coverage.

There are several various insurance policies, and recognizing which is appropriate for you can be challenging. This overview will certainly talk about the various kinds of insurance policy and also what they cover.

Relying on the policy, it can additionally cover dental and also vision care. When picking a medical insurance policy, you need to consider your details requirements and also the degree of insurance coverage you need. Life insurance is a policy that pays a sum to your beneficiaries when you pass away. It offers monetary protection for your loved ones if you can not support them.

Report this wiki page